#MyRefi was rolled out by The White House, it’s a new social media program to promote the Obama Refinance Plan with Twitter, Google+, email, and Facebook.

#MyRefi was rolled out by The White House, it’s a new social media program to promote the Obama Refinance Plan with Twitter, Google+, email, and Facebook.

In the official White House blog it states, underwater borrowers can save significant amounts of money if Congress acts and implements a broader refinance program, expanding beyond the current programs that exist for borrowers with Fannie Mae and Freddie Mac loans.

#MyRefi aims to build public support for the President’s proposals and increase pressure on Congress to put the proposals into law.

Click here to get today’s NJ HARP Mortgage Rates #MyRefi.

White House #MyRefi Page and Tools

On their #MyRefi page the White House offers you a tool that shows the type of loan program you could qualify for, if the #MyRefi program becomes law.

Here is the basic criteria for the #MyRefi program:

- Must have a private loan (your loan is not backed by Fannie Mae, Freddie Mac, FHA, or USDA).

- Must be refinancing the mortgage for your primary residence.

- Must have a mortgage less than $750,000.

- Must have made your payments on time the last 6 months and have no more than one 30-day late payment in the past 12 months.

- Must have a credit score that is above 580.

President Obama’s refinance plan calls for a simplified application process, with no appraisals, no tax forms and less red tape. This plan is similar to the HARP 2.0 mortgage done through a manual underwriting process (which is available only to HARP borrowers through their original lenders), but extends the program to more underwater borrowers.

#MyRefi: Do we really need a HARP 3 Refinance Program?

The current HARP 2.0 plan is limited because it only helps New Jersey borrowers with Fannie Mae and Freddie Mac loans. Depending which report you read the number of underwater homeowners varies from 11 million to 17 million borrowers.

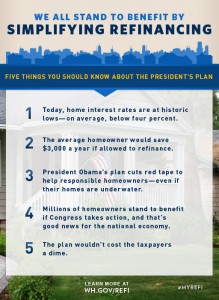

The White House, on their #MyRefi page lists five important points about the Refi plan, as follows:

- Interest rates are at historic lows, under 4%,

- Borrowers can save about $3000 per year.

- The plan is simple to operate and even underwater borrowers can benefit.

- The economy will benefit by helping millions of borrowers save money. However, it will take Congressional action.

- The cost to the taxpayers is zero.

Click here to get today’s NJ Mortgage Rates #MyRefi.

#MyRefi – Will HARP 3 Really Happen?

Although the White House makes their #MyRefi plan seem simple, the actual implementation of a wide ranging refinance plan is complicated. Here are some of the potential problems:

- #MyRefi – Political support for more government involvement in the housing and mortgage market. The #MyRefi program calls for a transfer of wealth to investors of private based mortgages to the current homeowners. (If the NJ homeowner is not underwater, then they can refinance their loan).

- #MyRefi – Who will fund the money? Who will guarantee the loans? Need to work out the technicalities relating to purchasing the loans.

- #MyRefi – What will the underwriting criteria and eligibility requirements.

Before the #MyRefi program, the HARP 1.0 program evolved into the HARP 2.0 program,. More New Jersey borrowers were eligible, due to less stringent credit and LTV requirements. And many underwater NJ borrowers have been unable to qualify for HARP 2.0 for one reason or another.

#MyRefi campaign is looking to build mass support from the American public. But will President Obama’s mass refinance plan be implemented?

Click here to get today’s NJ Mortgage Rates #MyRefi.